Financially Savvy: Build Your Budget

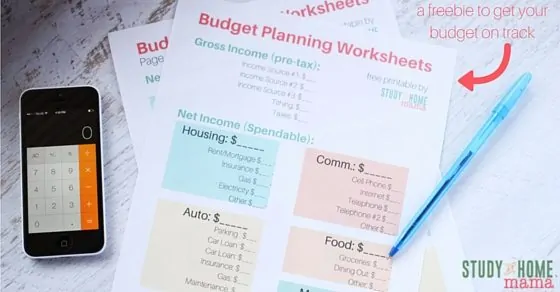

This week as part of the Financially Savvy Fridays series, I’m giving you an awesome (and pretty) set of Budget Planning Worksheets. These Printable Budget Planners will get all of your thoughts and numbers down in one place.

Not only have I created these pretty budget planning printables, I’ve also made a Google Spreadsheets version of my budget planner just in case you prefer paper-free! (As evidenced by my love of paper clutter, I’m definitely a “write it down” type.)

But I don’t want to just throw these free printable budget planners at you and leave you to figure out what everything means – I’m first going to go through the categories listed and how I suggest you should think about each category before you enter any numbers into your budget.

In general, I want to encourage you to focus on two things:

- Overestimate your expenses.

- Question your expenses.

How to Use These Free Printable Budget Planners

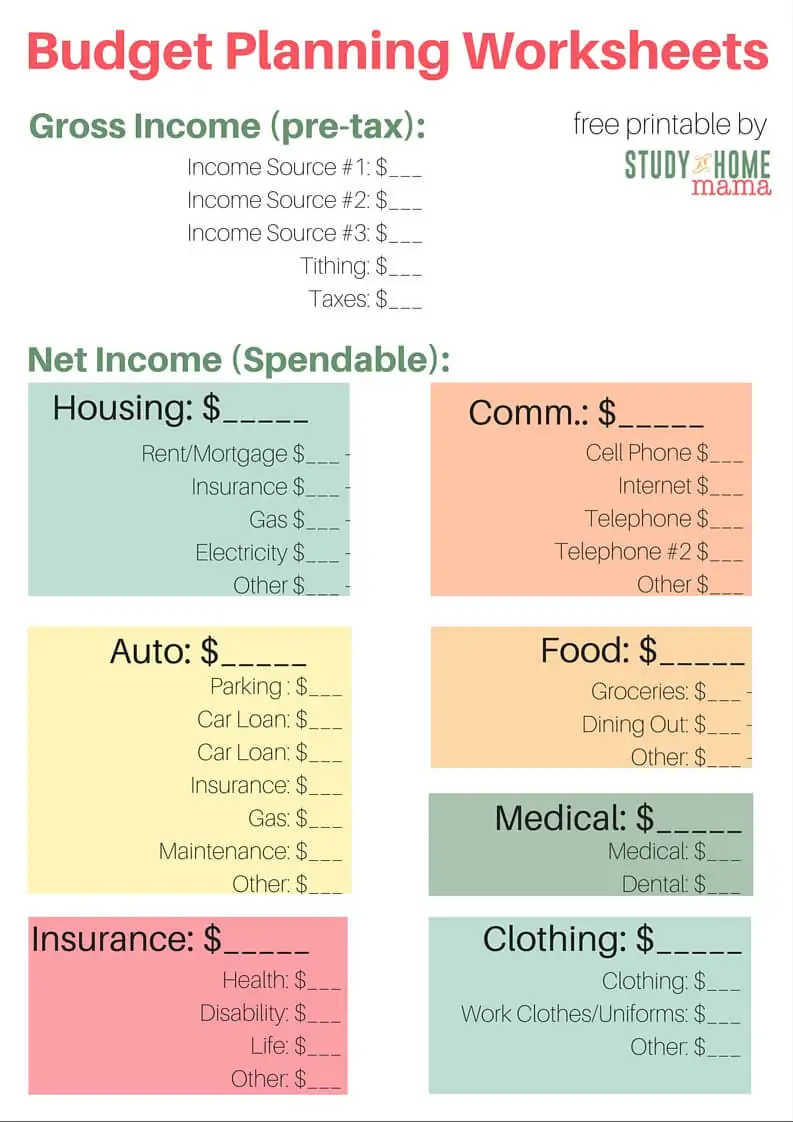

First, you need to know how much you make and you need to know your basic expenses.

If you receive a salary, this is easier, but consider any side work or income from government rebates or child support (etc) while filling out the gross income portion. Gather past bills and check to see what your services and subscriptions actually cost.

With taxes, you want to consider federal, provincial/state, and local taxes – including property tax. Round up with this one.

Housing Expenses

These numbers may fluctuate throughout the year based on your gas and electricity use during the colder months (or busier seasons) and are generally non-negotiable, unless you’re willing to downsize. (However you can save on heating and electricity bills with a few tips.) Fill these spots in with a generous average.

Auto/Transportation Expenses

If you use public transportation, replace one of the lines with that expense. If you regularly use taxis, commute to work, or chip in for a car pool, ensure that you add those expenses under “gas” or “other.”

This is the first category that we can start playing around with – start by filling in the prices that you currently pay (look at bank records or credit card statements to help) and then start thinking of ways you can reduce your costs.

Can you reduce your car insurance?

Can you reduce the amount of driving that you do to cut down on gas prices – or possibly even eliminate the need for a second car?

Is there a gas station near you that has cheaper gas prices, or bonuses for using their station?

Can you offer to carpool with someone to get some help on gas costs?

Insurance

While I included insurance for the home and car already, I cannot stress enough the importance of having insurance. If this is something you don’t have, make it a goal this month to call around and get estimates for different levels of coverage.

If you’re a parent, life insurance is a non-negotiable.

Health and dental insurance can be affordable – be sure to look into local programs or co-operative policies that tend to have lower prices or “geared to income” options.

Communications

Okay, I’m going to admit it: my phone plan is excessive. I could definitely pare it down, but I like the convenience of pulling over and using my maps feature if I’m a bit lost, or being able to go on Pinterest if I’m bored in the grocery check-out line. However, I know that I could get a basic plan and phone and reduce my payment from $90/month to $33/month.

For the convenience of checking social media on the go and having internet “with me” I am paying an additional $60/month or $720/year.

You may want to consider calling your providers and discussing different rate plans, bundles, or even cancelling phones. We opted to not have a house phone and make our long distance calls via Google Chat.

“Other” should take into account upgrades or repairs on technology, long distance calling, etc.

Food

There are so many ways to reduce in this area – meal planning, eliminating food waste, flyer matching, coupon clipping, making food from scratch, etc.

My biggest tip is recognize what’s a necessity versus what’s a treat. You’ll be surprised at how many sneaky treats make their way into your cart – three different types of bread, salad dressing when a simple spritz of olive oil and squeeze of lemon juice will suffice, coffee creamer when you can just use a splash of milk, etc.

As for dining out, be realistic as to what it costs you after tips and unexpected purchases – and include any take-out, drive-thrus, and delivery meals.

And while we’re at it, why do you dine out? Is it the experience, or just the ease of not cooking a meal? If it’s the latter, maybe pre-making some freezer meals or even purchasing some convenience-type dishes in advance and having them on hand for those busy days would be a more frugal option.

(“Other” could be hot lunch programs at school, gardening supplies, Ziplock bags, etc.)

Medical

Even with insurance, you often have some deductibles. Medical and dental are important to budget for so that if an expense comes up, the funds are already designated and you’re not left scrambling trying to figure out how to cover a prescription.

Clothing

Be realistic with this category: the kids are going to grow, clothes are going to get stained, new seasons will require new rain boots, snow pants, and bathing suits – respectively.

“Other” for me is toiletries and make-up, for you it might be shoes!

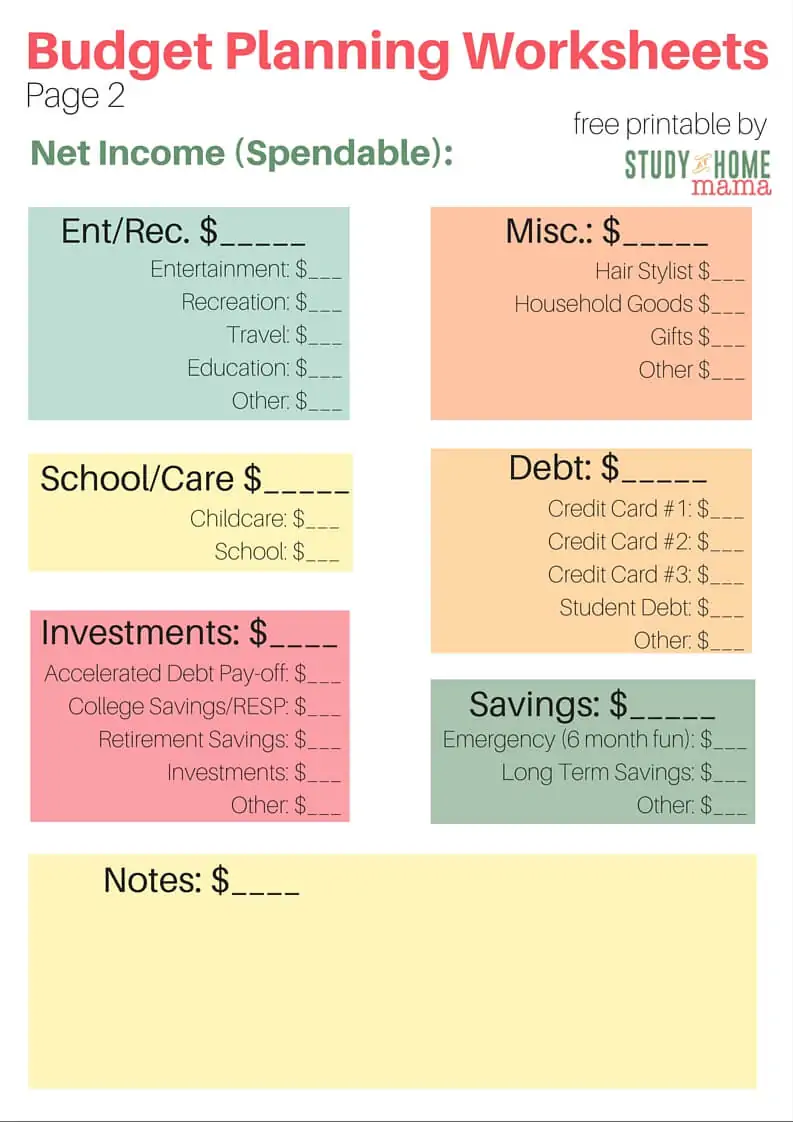

Entertainment/Recreation

I classify these as slightly different. Entertainment to me is a Netflix membership, going to a museum, or gas money to go on a road trip. Recreation is enrolling Ella in a gymnastics class or paying $2 to go skating on a Friday night.

Travel I budget for all year round and roll over unused funds, but for you it might make more sense to have a travel savings fund.

This is one area where you really need to question expenses – what do you pay for that can be gotten rid of? What can be creatively reduced?

We’ve rented new release movies from our library, downloaded coupons or looked up “freebie days” to local events, and even gotten rid of some sources of entertainment and recreation altogether! Having free play grounds and a giant box of free recyclables to craft from is an overlooked way to save!

School/Childcare

Even if your child goes to a “free” school, there are often expenses like lunch boxes, stationary supplies, field trips, science project supplies, etc. Budget for these and you won’t be groaning when your child comes home with yet another fundraising form…

I also like to budget for a bit of emergency childcare – while my parents usually help me out a night every week, I don’t want to be in a pinch if they fall sick and I have a deadline looming. The bonus of this is if I don’t use up the childcare fund, I can put it towards a fun activity we do together – or justify a much-need mom’s night out!

Miscellaneous

This can be a dangerous fund! Don’t go crazy putting all extra expenses as miscellaneous – this is really for those anomalies that just don’t fit typical budget categories. This can also be used to supplement unexpected expenses. (And if you have a pet, those expenses can be added here, too.)

For example, while I budget for internet, I may not budget for our router breaking. Ella might break something that needs replacing at a friend’s house. This fund covers all of that and can be rolled over into savings if left unused.

Debt/Investments/Savings

This is a topic for another day, but debt and your 6 Month Emergency Fund need to be your top priorities. If you have considerable debt or no emergency savings, you are going to want to go back through that budget and look for expenses to cut.

If you’d like to download the free printable budget worksheets, click here.

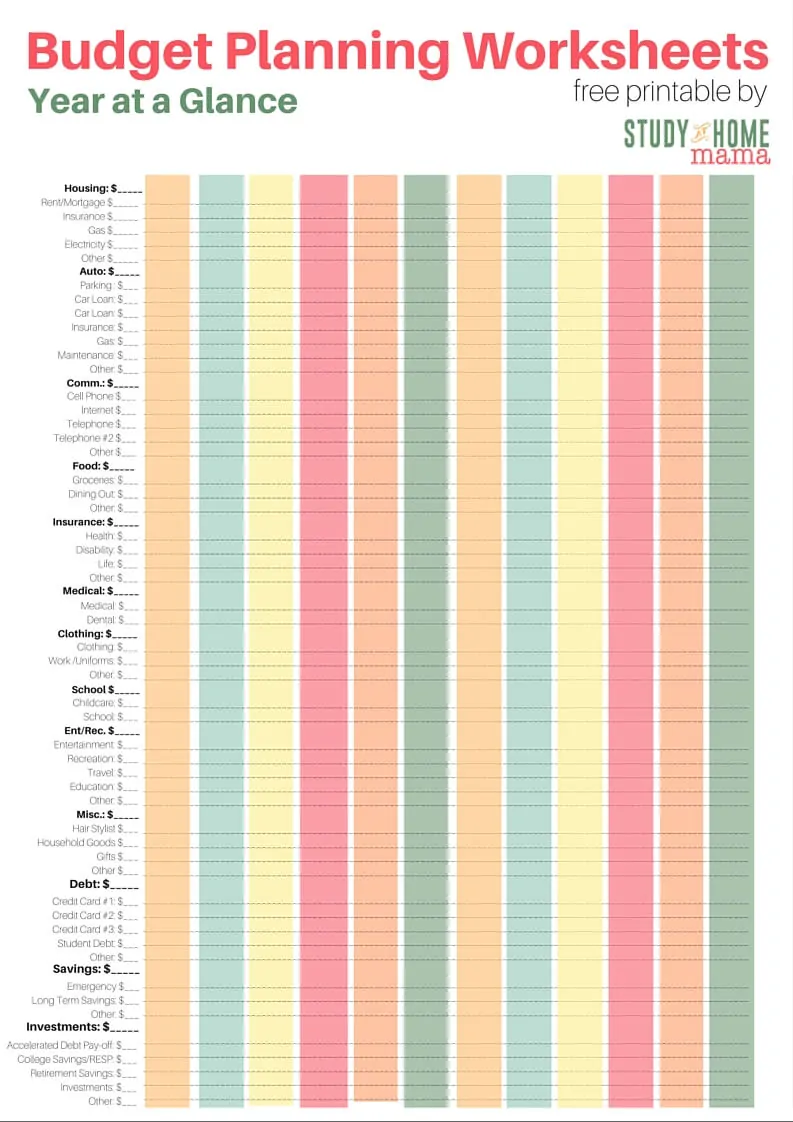

To download the “Year at a Glance” budget tracker, click here.

If you’d prefer the Google Spreadsheet version, click here and save a copy of the file for yourself by clicking “File” then “Make a Copy” OR “File” then “Download As.”

What do you think? Are there any categories or expenses you would add to these sheets?

Be sure to check out the rest of the Financially Savvy Fridays series here.

Hi,

The concept of insurance is rooted in the principle of spreading risk across a large pool of individuals. This risk-sharing mechanism is the foundation of insurance, allowing for the equitable distribution of the financial burden associated with unexpected events. In this way, insurance embodies a communal approach to risk management, emphasizing the collective responsibility of a group to support its members in times of need.

Thank you, a good point to keep in mind when opting for insurance.